UK drivers are being warned about a likely fuel duty increase in the upcoming Autumn Budget.

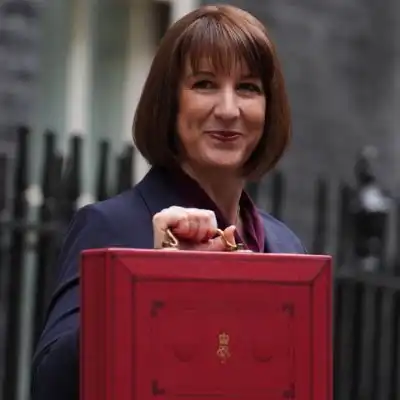

Prime Minister Sir Keir Starmer has highlighted a £22 billion gap in public finances that needs addressing, and Chancellor Rachel Reeves is expected to outline how it will be managed. One of the key areas under review is fuel duty—a tax added to the cost of petrol and diesel, which is already included in what you pay at the pump.

The government uses fuel duty to raise money, and although it has been set at 57.95p per litre since 2011, the previous Conservative government temporarily cut it by 5p per litre in March 2022. However, this reduction is costing the Treasury £2 billion annually, which could push the current government to reverse the cut.

In addition to fuel duty, 20% VAT is charged on fuel. According to the RAC, fuel prices should be lower based on current wholesale costs, but retailers have kept their margins higher than normal. RAC claims that petrol should be around 136p per litre (down from 142p) and diesel around 139p (down from 147p). Last week, retailers were making about 10p profit per litre, compared to the long-term average of 8p.

RAC’s head of policy, Simon Williams, believes the Chancellor believes, “We’ve reached the conclusion the Chancellor has no option but to put fuel duty back up to 58p a litre in October’s Budget.

“She knows the 5p discount is losing the Treasury £2bn a year. She also knows drivers were overcharged by a staggering £1.6bn last year according to the Competition and Markets Authority’s recent report.

“We’d normally be against any increase in duty, but we’ve long been saying drivers haven’t been benefitting from the current discount due to much higher-than-average retailer margins.

“As more and more EVs come on to the roads the Government will need to tax drivers differently. We think replacing fuel duty with a pay-per-mile system as soon as possible is the way forward as then the only tax levied on fuel would be VAT. This would give retailers nowhere to hide.”